Blog

Stay up to date with all the latest community association industry news. Subscribe to this blog and receive notifications of new posts by email here

Fall President's Message: Cautious Optimism

By , CMCA, AMS, PCAM

The Fall 2021 Issue of The Communicator focuses on architectural modifications and owners’ protected uses. Residents are drawn to common interest development living for many reasons. Among those reasons are the covenants, conditions, and restrictions that, in part, are designed to deliver a uniform and visually appealing community experience. However, layered over this, and sometimes in direct conflict with the association’s general plan as articulated through its governing documents, is a continually evolving stream of legislation that affords residents certain protections regardless of what the governing documents indicate. Over the years we have seen these protections applied to satellite dish installations, solar systems, flags and banners, vehicle charging stations and ADU/JDU units, to name just a few. To co-exist, associations must understand these protections and craft their rules and regulations, policies and procedures, and future amendments...

Three Ways to Supercharge Your Career

This article first appeared in The Communicator, Spring 2021. To read more, click here.

THE CAI BAYCEN Chapter is offering three exciting programs designed to help you achieve an advanced designation through CAI.

1 Mentoring Program

Do you need some tips on what classes to take? Do you want some guidance as you navigate the application process? The Designations Committee will match you with a mentor who has achieved the industry’s highest professional credential, the PCAM.

Your mentor will provide one-on-one support and guidance throughout credentialing and the designation process. This includes creating a personalized strategic plan for each candidate to obtain the AMS designations and preparing candidates for the PCAM case study.

2 Scholarship Program

We are offering scholarships of $250 to Community Managers who are chapter members in good standing to partially reimburse you for registration fees for any one of CAI’s six M200 level Professional Management Development Progr...

Innovative Ways to Plan, Fund, and Approve Community Amenity Projects

By William P. McMahon and Jeff Evans

This article first appeared in The Communicator, Spring 2021. To read more, click here.

Amenities for any community are important as they define a community’s purpose, its mission and what residents it is attempting to attract. If a community is trying to appeal to families, seniors, etc., it will offer a variety of amenities, such as dining, recreation, health care access, social programs, etc. For most communities, maintaining and continually updating facilities and programs is a never-ending challenge.

The original developer of a community will freely invest in amenities that will attract first-time homeowners. And, the marketplace demands highend amenities to be successful. The trouble is that in 10 or 20 years these amenities deteriorate and consequently depreciate. Few residents get excited about spending money on worn out amenities. So the value of properties begins to decline as the amenities themselves age and decline. This is the time...

How to Get Out of the Surplus/Excess Insurance Market

By Terri Guest, CIRMS, CMCA

This article first appeared in The Communicator, Spring 2021. To read more, click here.

In "Zoom Rooms" at the recent Legal Forum, a story was told about how a homeowners association had its insurance cancelled due to a claim. This association could no longer find coverage in preferred markets (admitted carriers, such as Farmers and Travelers) and was forced to get its insurance from a surplus lines carrier. Not only was this coverage three times the price, the added insult was that the claim was a result of an out of control car speeding down a street adjacent to the association and crashing into the association building – something impossible for the HOA to control.

The question then came up – what now? Once you have entered what we call the "surplus and excess" market – the carriers that folks go to when they can’t get coverage elsewhere – are you stuck? What can an association do, especially when the claim that landed them there originated outside t...

Earthquakes, Hurricanes, Hailstorms, and Other Catastrophic Damage

Parametric insurance to the rescue

By Austin James, CPCU, ARM

This article first appeared in The Communicator, Spring 2021. To read more, click here.

Every year our country experiences catastrophic weather threats in a variety of forms. This could come from hurricanes, wildfires, hail storms, earthquakes, and blizzards. Many of these events can cause damage that reaches into billions of dollars. There are a lot of insurance companies that protect against these catastrophic claims; however, most have high deductibles and there are a lot of exclusions. A product has arisen in the marketplace to fill the coverage gaps excluded by traditional insurance and help to pay for losses beneath the deductible: parametric insurance.

How Does Parametric Insurances Differ From Our Current Insurance?

Parametric insurance is an index-based insurance product that has been around for decades in the reinsurance space. Its goal is to provide immediate funds to the policy holder when a specific eve...

Skyrocketing Construction Costs Leave HOAs to Cope with Underfunded Projects

Tackling the uncertainties: best practices for bidding, budgeting, and contracting in HOA projects.

By Regan Brown and Chris Sigler, B.S.C.E., CDT

This article first appeared in The Communicator, Spring 2021. To read more, click here.

Over the past four years, skyrocketing construction costs have created various forms of havoc throughout the construction industry, to the surprise of many HOAs in need of project work. The increases have taken on various forms. In 2017-18, a strong economy and a demand for housing fueled a labor shortage, showing an overall increase of almost 30 percent in construction costs nationwide; in 2019, political tariffs and multiple natural disasters fueled the next wave of increases, this time affecting material costs.

The Pandemic’s Impact On Cost Increases

2020, the year that will go down in history for the global pandemic, brought several new factors creating price changes that we had not experienced before. When the shelter in place orders started i...

Effective Communication During a Construction Defect Claim in the New Normal

By Ritchie Lipson, Esq. and Scott Thomson, Esq

This article first appeared in The Communicator, Spring 2021. To read more, click here.

Effective communication within a homeowners association is always important. Once an association brings a construction defect action against the builder, communication and cooperation among the board, community association manager, and the construction defect attorney become essential. However, with the outbreak of COVID-19, communication and cooperation regarding construction defects will most likely remain permanently changed.

A construction defect action by a homeowners’ association usually begins with a Notice of Commencement of Legal Proceedings under the Calderon Act (Civil Code § 6000 et seq.), which concurrently meets the need for a Notice of the Claim pursuant to SB800. However, before the attorney may prepare such notice, he or she must investigate the defects in the community and discuss the identified defects with the board and the comm...

What Now, Karen?

Dealing with homeowner anxiety and complaints about neighbors or the association.

By Sandra L. Gottlieb, Esq., CCAL

This article first appeared in The Communicator, Spring 2021. To read more, click here.

Karens became famous in 2020. If you don’t know what a Karen is, it’s a special breed of entitled person. Karen hates everything and everyone, including your dog, trees, the association, and association assessments. She’s a stickler for rules, but they don’t apply to her. A meme was going around social media recently stating that a group of Karens is called a homeowners association. We who work in the industry know that there are some power-hungry, rules-obsessed, self-dealing board members out there, but those of us who participate in CAI aren’t among them; we value education and look to strengthen community.

We don’t want managers and board members to be seen as Karens; you all work too hard for your correct labels. Remember that proactive communication can reduce homeowner anx...

LSC: Be the Change

By Janet Quinn-Dennis

This article first appeared in The Communicator, Winter 2021. To read more, click here.

Early in my career I realized that I was frustrated with many of the laws that affected the CID industry. Case law, as well as legislative law, seemed ineffective at holding back the tide of special interest groups that wanted to have a say in the way our homeowners and directors lived their lives.

Then, sometime in the mid-1980s, I was introduced to a mentor who would show me ways in which I could legislatively direct my passion for this industry. This person was the one and only Beth Grimm. She was heavily involved in CAI’s California Legislative Action Committee (CLAC). Beth served as a delegate for the Bay Area/Central Chapter, as well as the PR chair on the Executive Committee. She encouraged me to participate on the local Legislative Support Committee (LSC) at that time and introduced me to other statewide delegates.

The hook was set during my first Legislative Day a...

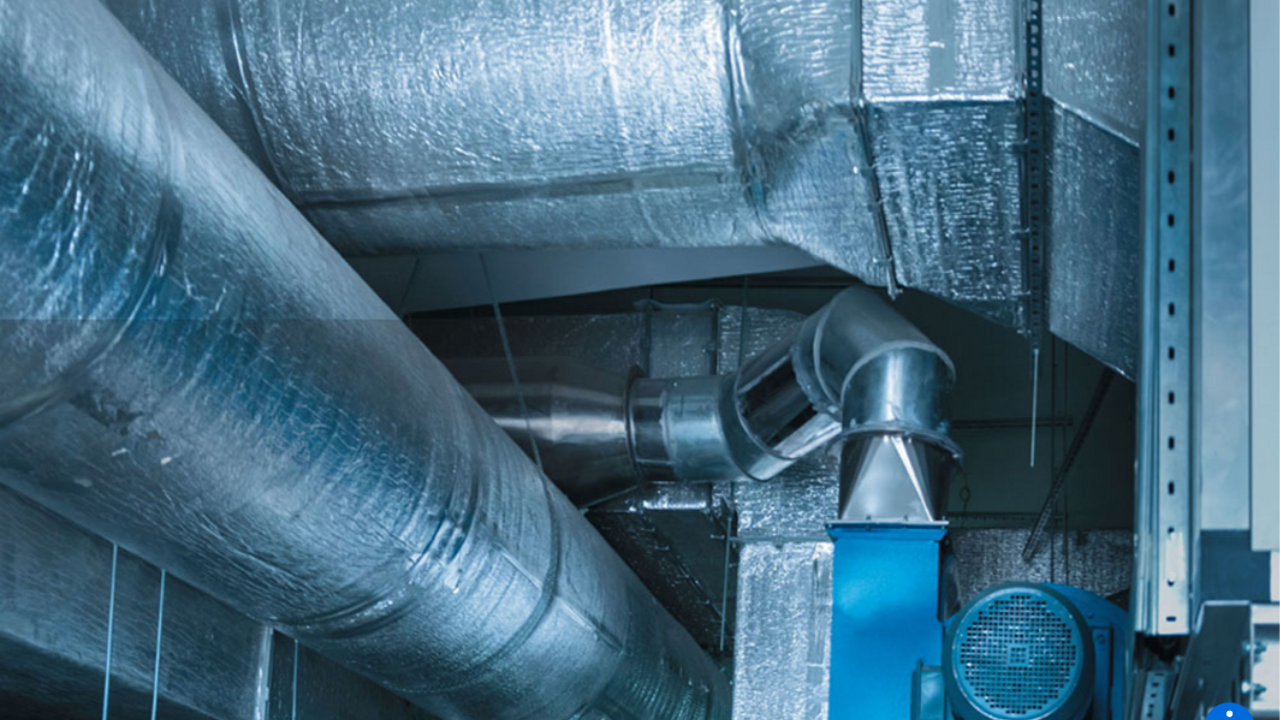

HVAC Maintenance, Defects, and Disclosures in the Coronavirus Era

By Ritchie Lipson, Esq., Brittany Grunau, Esq., and J. Scott Friesen, P.E.

This article first appeared in The Communicator, Winter 2021. To read more, click here.

As COVID-19 continues to spread throughout the population and the scientific community is still researching the many unknowns of the virus, it is vital that managers and boards of directors are diligent in their maintenance of buildings so as to keep occupants safe as well as to avoid potential liability. An open letter supported by 239 scientists, dated July 6, 2020, stated that there is a "real risk" that the coronavirus can be airborne. (Morawaska L, Milton, D. It is Time to Address Airborne Transmission of COVID-19, July 6, 2020). While there is little information known on ventilation and filtration requirements and the impact on the spread of COVID-19, it can be reasonably inferred that knowledge of how your system works and reacting accordingly could be an important mitigation factor. Maintenance of HVAC systems and ...